Illinois Used Car Sales Tax 2020 . the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. There is also between a 0.25% and 0.75% when it comes. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full. if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay.

from www.illinoispolicy.org

illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. There is also between a 0.25% and 0.75% when it comes. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party.

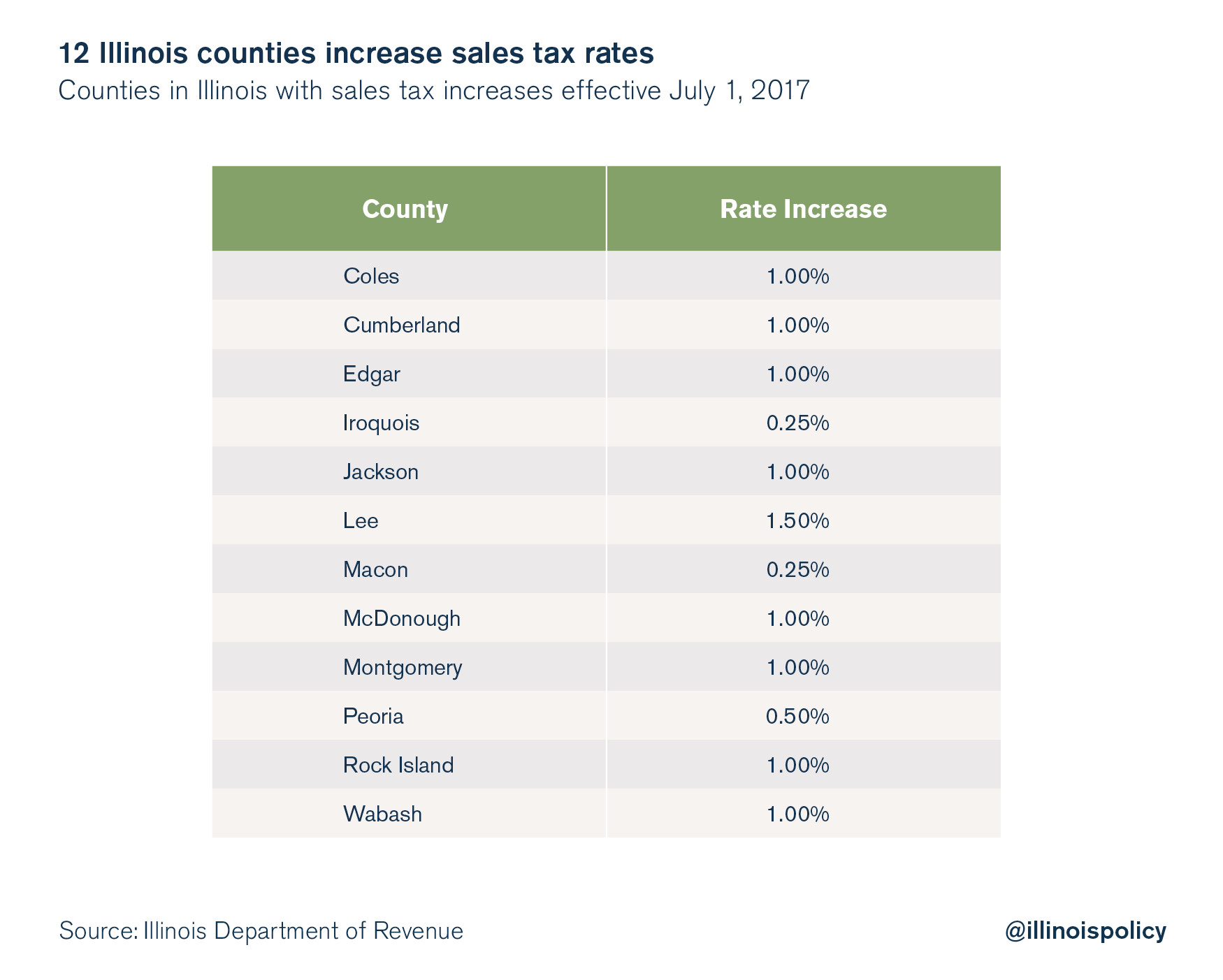

Sales tax hikes take effect in 50 Illinois taxing districts

Illinois Used Car Sales Tax 2020 illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full. There is also between a 0.25% and 0.75% when it comes. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles.

From www.concn.ca

Illinois Sales Tax On Used Cars Calculator Outlet www.concn.ca Illinois Used Car Sales Tax 2020 if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions.. Illinois Used Car Sales Tax 2020.

From netla.hi.is

Illinois Sales Tax On Used Cars Calculator Cheap Sale netla.hi.is Illinois Used Car Sales Tax 2020 illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. There is also between a 0.25% and 0.75% when it comes. if you’re buying a new. Illinois Used Car Sales Tax 2020.

From legaltemplates.net

Free Illinois Bill of Sale Forms PDF & Word Legal Templates Illinois Used Car Sales Tax 2020 There is also between a 0.25% and 0.75% when it comes. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay. illinois collects a. Illinois Used Car Sales Tax 2020.

From exokessdc.blob.core.windows.net

Bloomington Il Vehicle Sales Tax at Jeffery Conner blog Illinois Used Car Sales Tax 2020 illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. . Illinois Used Car Sales Tax 2020.

From www.napletonshyundaiofurbana.com

New Illinois TradeIn Tax Starting Jan 1st, 2020 Napleton's Hyundai of Urbana Illinois Used Car Sales Tax 2020 sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois collects a 7.25% state sales tax. Illinois Used Car Sales Tax 2020.

From pannaindywidualna.blogspot.com

Illinois Used Car Sales Tax 2020 Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Illinois Used Car Sales Tax 2020 sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full. if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay. There is also between a 0.25% and 0.75% when. Illinois Used Car Sales Tax 2020.

From 2020blog.us

States With the Highest Sales Taxes 2020 Blogging Illinois Used Car Sales Tax 2020 illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. There is also between a 0.25% and 0.75% when it comes. the tax is imposed on. Illinois Used Car Sales Tax 2020.

From upstatetaxp.com

State and Local Sales Tax Rates, 2020 Upstate Tax Professionals Illinois Used Car Sales Tax 2020 the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. There is also between a 0.25% and 0.75% when it comes. if you’re buying a. Illinois Used Car Sales Tax 2020.

From www.carsalerental.com

How Much Is Used Car Sales Tax In Illinois Car Sale and Rentals Illinois Used Car Sales Tax 2020 the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual. Illinois Used Car Sales Tax 2020.

From pannaindywidualna.blogspot.com

Illinois Used Car Sales Tax 2020 Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Illinois Used Car Sales Tax 2020 illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. There is also between a 0.25% and 0.75% when it comes. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the tax is imposed on motor vehicles purchased (or acquired. Illinois Used Car Sales Tax 2020.

From www.illinoispolicy.org

Sales tax hikes take effect in 50 Illinois taxing districts Illinois Used Car Sales Tax 2020 illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. . Illinois Used Car Sales Tax 2020.

From www.carsalerental.com

What Is Illinois Sales Tax On A Car Car Sale and Rentals Illinois Used Car Sales Tax 2020 if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. sales taxes in illinois are calculated before rebates are applied, so the buyer who. Illinois Used Car Sales Tax 2020.

From www.carsalerental.com

Illinois Auto Sales Tax Used Car Car Sale and Rentals Illinois Used Car Sales Tax 2020 illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay.. Illinois Used Car Sales Tax 2020.

From exohxanqx.blob.core.windows.net

Illinois Tax On Car Sale at Jacqualine Barney blog Illinois Used Car Sales Tax 2020 illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay. There is also between a 0.25% and 0.75% when it comes. sales taxes in. Illinois Used Car Sales Tax 2020.

From materialmediaschulth.z19.web.core.windows.net

Illinois Vehicle Tax Chart Illinois Used Car Sales Tax 2020 sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full. There is also between a 0.25% and 0.75% when it comes. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. the statewide sales tax. Illinois Used Car Sales Tax 2020.

From webinarcare.com

How to Get Illinois Sales Tax Permit A Comprehensive Guide Illinois Used Car Sales Tax 2020 illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales. Illinois Used Car Sales Tax 2020.

From giowqmsyi.blob.core.windows.net

Used Vehicle Sales Tax In Illinois at Allen Firkins blog Illinois Used Car Sales Tax 2020 sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. the tax is imposed on motor vehicles. Illinois Used Car Sales Tax 2020.

From dxolsfeet.blob.core.windows.net

Vehicle Sales Tax Il at Joshua Smith blog Illinois Used Car Sales Tax 2020 illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. if you’re buying a new or used car, it’s important to know the taxes and fees you may have to pay. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still. Illinois Used Car Sales Tax 2020.